Electric motor Money Best Blog 8879

The smart Trick of How To Invest That Nobody is Talking About

Not known Facts About Financial Advice Websites

If you don't really feel like you're obtaining a truly clear description of these points, either through the website, at the branch on the phone, then it's most likely an actually excellent sign that this is maybe a financial institution that's mosting likely to be a lot a lot more transactionally-oriented instead of one that will be concentrated on offering recommendations and also advice, Mc Adam discusses.

While financial institutions are introducing and also presenting even more electronic devices, a virtual experience can not replace what people can offer. Amongst capitalists searching for wide range administration suggestions, for instance, there's a preference for crossbreed designs that incorporate recommendations from electronic systems as well as real individuals. "The idea of scaling suggestions to digital networks is not binary.

Recognition, verification, support these things will certainly not go away. It does not matter how rich the electronic experiences obtain. There is a demand for those things as well as lots of people desire those things delivered through a human..

Not known Facts About Online Finacial Advice

5. Forbes When you think of the economic expert magazine Forbes, you could think that the style as well as web content would be stagnant as well as outdated. Yet nowadays, that's much from the reality. Forbes supplies considerable updated news from worldwide regarding organisation, economics, spending, and also financial markets.

For those operating in the monetary market, Forbes showcases up-and-coming business owners, startup companies, and technology innovation that are expected effect how we function, live, as well as play. For those of you who such as http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/finance tips financial investment newsletters, have a look at their web site since they supply numerous kinds, including one targeted at young female entrepreneurs.

Picking an economic expert in Cleveland Financial experts utilize their education and experience to guide customers to their monetary objectives. So, if you have actually simply experienced a major life adjustment or you're just seeking an experienced point of view, take into consideration employing an economic advisor in Cleveland. Several monetary experts require customers to have $50,000 or even more in properties.

A Biased View of Finance Blogs

Kinds of monetary experts There are several types of monetary experts in Cleveland with different certifications as well as specializeds such as financial coordinators, retirement coordinators as well as investment advisors. There are also automated profile and also asset administration services, usually called robo-advisors. A robo-advisor is a software-based solution for asset monitoring that's usually the very best alternative when you begin conserving.

Several investment consultants in Cleveland are fiduciaries, which indicates they comply with a lawful and moral criterion that forces them to act in their clients' finest rate of interests. Non-fiduciaries normally https://www.washingtonpost.com/newssearch/?query=finance tips just have to fulfill the sustainability standard of offering suitable recommendations. The difference right here is that non-fiduciaries are able to recommend alternatives that benefit themselves even more than the option that's purely best for the customer.

Commission-only advisors charge a percentage of the funds spent, usually in between 3 as well as six percent. Robo consultant charges are normally much reduced, in some cases as low as 0.25 to 0.5 percent. Other advisors bill a percent of your overall possessions under administration Visit website and pull this fee straight from your account. These advisors are additionally the most likely to have minimal investment quantities.

Top Guidelines Of Online Finacial Advice

Per hour rates range between $120 and $300. Retainer charges range from $2,000 to $11,000 for a year of solution. It's crucial that your consultant is clear about just how they make money to ensure that conflicts of rate of interest do not happen, such as a consultant making referrals for a customer based upon the payment they will certainly obtain rather than acting their best rate of interest like a fiduciary.

What qualifications ought to an economic consultant have Financial consultants in Cleveland have a range of titles as well as credentials, including Qualified Financial Planners, Chartered Financial Professionals or Chartered Financial Investment Counselors, among others. When considering a financial expert for asset monitoring in Cleveland, ask the adhering to questions: Just how do you make your earnings What certifications do you have Are you a fiduciary What experience do you have What kinds of clients are you seeking What should my assumptions be Just how and just how commonly are we able to connect Have you ever before been convicted of a crime or explored by a specialist organization or regulator Usage resources like the Financial Sector Regulatory Authority's Broker Examine or the Securities as well as Exchange Payment's documents to check your consultant's credentials and background prior to trusting them with your cost savings.

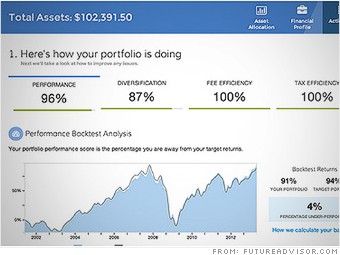

Wealthfront Wealthfront provides free, automated investment monitoring and financial preparation for the very first $10,000 spent. It's a valuable service for tiny balances and also supplies tax-efficient functions like Direct Indexing administration of 529 college cost savings strategies, something none of its rivals offer. Future Expert Future Consultant is a robo-advisor that provides some totally free services, such as a comprehensive retirement planning analysis.

An Unbiased View of Financial Advice

It also provides accessibility to a group of monetary advisors. Future Advisor web site Personal Resources Personal Funding provides much more one-on-one advice for investors. Its spending site utilizes computer system formulas, yet human financial consultants are coupled with each client to aid you make your choices. The costs are a bit greater therefore fees vary from 0.49 to 0.89 percent per year relying on the dimension of your account.

Theme Investing Theme is a wonderful means to buy suggestions without massive inconvenience or expenditure. Teams of approximately 30 safety and securities are created by a team member there are nearly 100 motifs to select from as well as you can trade them for just $9.95 each, fairly low charges for that kind of purchase.

It's cost-free to open up as well as keep an account, as well as Options Residence uses professional-grade stock analysis study as well as outstanding trading tools. However, it's not the very best for mutual fund and also exchange-traded fund investors. TD Ameritrade TD Ameritrade's profession expenses are on the high side ($ 9.99), yet it provides excellent trading systems that seasoned traders like.

Financial Advice for Beginners

There's no account minimum, and TD Ameritrade supplies complimentary study as well as information, which can be really useful. Charles Schwab Charles Schwab is a leading pick for numerous reasons. The company supplies full-service therapy if you live close to among its branches there are 300 throughout the country. Online, you can find a lot of educational sources as well as fantastic mobile trading systems as well as tools.

It supplies a choice of financial investment items, including bonds, http://edition.cnn.com/search/?text=finance tips ETFs as well as common funds. The cost is $3.50 per contract per side, yet you can save cash if you're a high-volume investor. Merrill Side Merrill Edge definitely attracts attention because of its research offerings from Bof A Merrill Lynch Global Study as well as Morningstar, S&P, Capital INTELLIGENCE as well as more.

https://www.youtube.com/embed/_cn25geQtLM

Reduced costs and tax cost savings The annual cost is 0.30% of the possessions we take care of for you. That's $3 for each $1,000 in your portfolio, with a $50,000 minimum. By integrating inexpensive funds as well as tax-smart approaches, our consultants optimize your tax obligation financial savings so you can maintain more of your cash.

An Unbiased View of Financial Advice

Inc. Magazine Unveils Its Annual List of America's Fastest-Growing Private Companiesthe Inc. 5000. For the fifth Time, Pure Financial Advisors appears on the Inc. 5000! Inc. publication today revealed that Pure Financial Advisors, Inc. has actually ranked on its annual Inc. 5000 list, the most distinguished position of ...

Here's the important things: When I originally collaborate with customers, my objective is to state as

About Online Finacial Advice

Edit your About page from the Pages tab by clicking the edit button.

What Does Finance Blogs Do?

Some Known Factual Statements About Financial Advice

Quickly, individuals may be pertaining to you for complimentary financial suggestions. And unlike Uncle Fred, you won't inform them to hide all their cash money in half-empty grain boxes.

Live - Weekdays 2-5pm EST Dave Ramsey began on one station in Nashville back in 1992, sharing functional solutions for life's difficult cash concerns. Today, the program gets to 15 million combined weekly listeners. From You Tube to your preferred podcast app, listen and see the program anytime, anywhere. Pay Attention or Enjoy Now.

But customer supporters say that the very best interest policy does little to reinforce capitalist securities or remove disputes of rate of interest, such as recommending financial investments that would pay the broker higher commissions. "The responsibilities of what benefit means are not plainly specified," claims Barbara Roper, director of investor protection for the Consumer Federation of America, a not-for-profit team.

Guideline Best Rate of interest will certainly much better offer investor interests by ensuring capitalists are afforded solid protections when they obtain referrals from broker-dealers, says Paul Schott, president and also Chief Executive Officer of the Financial Investment Business Institute, a profession group. The SEC will also call for that both financial investment advisers as well as brokers supply disclosure types to clients that explain fees and also any type of problems of rate of interest.

Finance Advice Online Fundamentals Explained

The disclosure rule doesn't need that brokers make certain customers recognize them, Evensky claims. The capacity for confusion might be greatest for clients of so-called crossbreed advisors, those who work both as brokers as well as financial investment advisors. "If you are an investor in among these firms, you may have numerous accounts, such as pension as well as broker agent accounts," says Roper.

But it's not clear whether the new analysis will certainly have much effect on the method of financial investment advisers. "We see the fiduciary requirement as being as durable as ever," claims Gail Bernstein, general counsel of the Financial investment Adviser Organization, a not-for-profit group representing financial investment advisor Look at this website companies. "Nothing precludes investment advisors from being fiduciaries.".

I approximate that 80% of financial news australia today physicians require, want, as well as should utilize a financial planner and/or an investment manager. Some financial investment masters such as William Bernstein, MD, believe my price quote is method also low. Anyway, if you desire to utilize an expert momentarily or https://www.investopedia.com/ for your whole life, there is no reason to really feel guilty about it, simply ensure you are obtaining excellent suggestions at a fair price.

See the base of the page for even more details on the vetting. # 1 Wrenne Financial Planning At Wrenne Financial Preparation, our interest is helping young doctors make use of cash to construct even more area as well as liberty in their lives so they can focus on what truly matters. This starts with a well created financial plan.

How To Invest Can Be Fun For Everyone

Via conducting hundreds of meetings with medical professionals all throughout the country, we've obtained pretty great at helping you through this. Yet the genuine value comes when you begin to experience the advantages of your effort. Points like relocating towards monetary freedom and feeling on-track with your goals. Our enthusiasm is assisting our customers understand these incredible benefits of economic preparation.

We would certainly love to talk more about how we could be able to assist you. Feel complimentary to schedule a cost-free 30 minute consult. Most Current WCI Podcast Appearance # 2 CMG Financial Consulting Clint Gossage CFA, CFP, Certified Public Accountant, has been married to a Surgical Oncologist for the http://www.thefreedictionary.com/finance tips past 15 years and also has actually experienced first-hand the ups and downs on the trip from basic to becoming a going to.

He has actually been aiding physicians and also physician ever because to obtain out of student financing financial obligation, save cash, buy tax obligation effective methods, manage and protect their possessions and also provide back their most scarce resourcetime. CMG Financial Consulting. Most Current WCI Podcast Look # 3 Real North Wealth/Idaho Medical Association Financial Solutions At Real North Wide range, stability as well as our dedication to our clients come initially.

We pride ourselves in being a fee-only company and a fiduciary on every relationship. We recommend on our clients' entire financial picture real extensive preparation. By working with financial investment, retired life, estate, tax, insurance policy, and also small organisation preparation, we ensure every economic aspect of your life operates in synchrony to your best interest.

Finance Blogs Things To Know Before You Get This

We have two True North Wealth workplaces in Utah, situated in Salt Lake City as well as Logan. We also have an office in Boise, Idaho, working as Idaho Medical Association Financial Services yet we deal with clients across the nation. Providers: Financial planning, Financial investment management, estate preparation, tax obligation planning Charge Framework: AUM fee Area: Logan, UT, Salt Lake City, UT, and also Boise, ID Additional Details, True North Riches Financial Consultant Application, ADV 2 Site, email protected, (801) 316-8175 Newest WCI Podcast Appearance # 4 Targeted Wealth Solutions Targeted Wealth Solutions is an independent, fee-only monetary planning and also investment monitoring firm started by former US Flying force pilots.

As boxer pilots, we served alongside several tsx and dow of the best flight specialists in the armed force. We saw just how remaining in a demanding profession with a large amount of outer responsibilities triggered tension over the lack of time offered to invest in expert and personal quests that truly mattered to our trip specialists.

Please really feel free to call us to schedule a free consult. Providers: Financial preparation, financial investment management, work environment retired life plans Charge Structure: Hourly, AUM charge Place: Stone, Carbon Monoxide, Denver, CO, and Colorado Springs, CO Extra Info, Targeted Wide Range Solutions Application, ADV 2 Web site, e-mail secured, (303) 800-8179 Latest WCI Podcast Look # 5 Panoramic Financial Guidance Panoramic Financial Guidance is a virtual, fee-only monetary planning company concentrating on younger doctors as well as doctor households.

Creator Andrew Mc Fadden, CFP, MBA, has been serving young doctor families for over 8 years, as well as is looked for out by https://www.washingtonpost.com/newssearch/?query=finance tips residency programs to speak and educate young doctors. His strong preparation method assists young physicians achieve https://en.search.wordpress.com/?src=organic&q=finance tips that sought after equilibrium of preparing well for the future, while having the ability to take pleasure in the here and now.

Not known Facts About Online Finacial Advice

Latest WCI Podcast Appearance # 6 Honesty Riches Solutions Stability Wealth Solutions (IWS) is a tiered flat-fee property monitoring and financial preparation company concentrated on helping doctors, dental practitioners, individuals and also local business owners in a clear and fair manner. We follow low-priced, tax-efficient portfolios based upon the client's detailed financial planning goals.

Our wide range administration fees range in between $1,250 to $3,750 a quarter, which consists of both investment monitoring and monetary planning. We are thrilled to see just how we can assist you! Please call Justina Welch or Clint Thomas for a complementary consultation. # 7 Fox & Company Wealth Monitoring Johanna Fox Turner, CPA, CFP, RLP Johanna is the creator of Fox & Co

https://www.youtube.com/embed/P2DlV_JN0Ds

. Wealth Management. Both firms use a flat charge framework for year-round planning, financial investment administration, and tax services for doctors as well as dentists. 90% of our business is virtual as well as you can be 100% particular you're dealing with a fiduciary. Johanna has 36 years of experience encouraging organisation and also HNW customers on wide range protection and all natural monetary preparation, consisting of tax approaches, estate planning, company operations and also succession preparation.

# 8 Doctor Riches Provider When my other half was in residency, I experienced just how prone she was to poor economic recommendations. I was stunned at the amount of consultants tried to make the most of her as well as her peers. It's the factor I started my fee-only practice, Physician Riches Services, to function solely with physicians that could really take advantage of impartial, quality economic advice.

The smart Trick of Online Finacial Advice That Nobody is Discussing

To help them really feel in control of their cash, similarly that you make a patient feel far better regarding their health and wellness. Also, I hold the Learn more Financial Residency podcast, a cost-free resource to help boost your financial proficiency. Come join the area! Right here is the podcast meeting I did with WCI in September 2018.

Fascination About Online Finacial Advice

Finance Advice Online for Beginners

Quickly, people may be pertaining to you free of cost monetary advice. And Also unlike Uncle Fred, you will not inform them to hide all their money in half-empty cereal boxes.

Live - Weekdays 2-5pm EST Dave Ramsey started on one station in Nashville back in 1992, sharing sensible answers for life's hard cash inquiries. Today, the show gets to 15 million incorporated regular listeners. From You Tube to your favored podcast app, pay attention and see the show anytime, anywhere. Listen or Watch Now.

However consumer supporters say that the very best rate of interest regulation does little to strengthen financier securities or remove disputes of passion, such as advising investments that would certainly pay the broker higher commissions. "The obligations of what benefit ways are not clearly specified," claims Barbara Roper, director of financier protection for the Consumer Federation of America, a nonprofit group.

Law Benefit will much better offer financier rate of interests by ensuring financiers are paid for strong defenses when they receive recommendations from broker-dealers, claims Paul Schott, president as well as Chief Executive Officer of the Investment Firm Institute, a trade team. The SEC will additionally require that both investment advisors as well as brokers give disclosure types to clients that explain charges and any problems of rate of interest.

The 6-Minute Rule for Finance Advice Online

The disclosure rule doesn't require that brokers make certain customers comprehend them, Evensky states. The possibility for complication may be highest possible for clients of so-called hybrid advisers, those who work both as brokers as well as investment advisers. "If you are a financier in among these companies, you might have several accounts, such as pension and brokerage firm accounts," claims Roper.

But it's unclear whether the brand-new analysis will have much effect on the technique of investment consultants. "We see the fiduciary criterion as being as durable as ever," says Gail Bernstein, basic counsel of the Financial investment Advisor Association, a not-for-profit group standing for investment adviser companies. "Absolutely nothing prevents investment consultants from being fiduciaries.".

I approximate that 80% of doctors require, want, and need to make use of a financial organizer and/or a financial investment manager. Some financial investment masters such as William Bernstein, MD, think my quote is method too reduced. At any price, if you wish to utilize an advisor temporarily or for your entire life, there is no factor to really feel guilty regarding it, just ensure you are obtaining great suggestions at a fair rate.

See all-time low of the page for more details on the vetting. # 1 Wrenne Financial Planning At Wrenne Financial Planning, our enthusiasm is helping young doctors use money to construct even more space as well as flexibility in their lives so they can concentrate on what really matters. This begins with a well created monetary plan.

About Finance Advice Online

With conducting thousands of conferences with physicians all across the country, we've obtained respectable at helping you with this. Yet the genuine worth comes when you begin to experience the advantages of your effort. Things like approaching lifehack.org/articles/money/top-10-highly-useful-websites-learn-about-personal-finance-for-free.html financial freedom and sensation on-track with your goals. Our interest is helping our clients understand these awesome advantages of economic preparation.

We would certainly love to chat more concerning just how we may be able to aid you. Feel cost-free to set up a complimentary half an hour get in touch with. Most Current WCI Podcast Look # 2 CMG Financial Consulting Clint Gossage CFA, CFP, CPA, has been married to a Surgical Oncologist for the previous 15 https://www.moneycrashers.com/best-financial-education-websites/ years and also has experienced first-hand the ups and downs on the journey from undergrad to becoming a going to.

He has actually been aiding medical professionals and also physician since to leave trainee finance financial obligation, conserve cash, buy tax http://www.bbc.co.uk/search?q=finance tips efficient techniques, take care of and also safeguard their properties as well as provide back their most limited resourcetime. CMG Financial Consulting. Latest WCI Podcast Appearance # 3 True North Wealth/Idaho Medical Association Financial Solutions At True North Wealth, integrity as well as our commitment to our clients come first.

We satisfaction ourselves in being a fee-only company as well as a fiduciary on every connection. We suggest on our customers' whole economic picture true thorough planning. By collaborating investment, retirement, estate, tax, insurance coverage, as well as local business planning, we make certain every monetary element of your latest financial advice news life works in synchrony to your benefit.

Not known Details About How To Invest

We have two Real North Wide range offices in Utah, located in Salt Lake City and Logan. We also have a workplace in Boise, Idaho, operating as Idaho Medical Association Financial Providers but we deal with customers throughout the nation. Providers: Financial preparation, Investment monitoring, estate preparation, tax obligation strategizing Cost Structure: AUM cost Location: Logan, UT, Salt Lake City, UT, and Boise, ID Additional Details, Real North Wealth Financial Consultant Application, ADV 2 Website, e-mail protected, (801) 316-8175 Newest WCI Podcast Appearance # 4 Targeted Wide Range Solutions Targeted Wide Range Solutions is an independent, fee-only economic preparation and financial investment administration company established by previous US Flying force pilots.

As fighter pilots, we served together with several of the most effective flight doctors in the military. We saw exactly how remaining in a requiring profession with a large quantity of outer obligations caused anxiety over the lack of time offered to invest in specialist as well as individual quests that truly mattered to our flight cosmetic surgeons.

Please feel free to call us to schedule a complimentary seek advice from. Solutions: Financial planning, financial investment management, workplace retirement prepares Cost Framework: Hourly, AUM charge Area: Rock, CO, Denver, Carbon Monoxide, as well as Colorado Springs, CO Additional Details, Targeted Wide Range Solutions Application, ADV 2 Web site, email safeguarded, (303) 800-8179 Most Recent WCI Podcast Appearance # 5 Panoramic Financial Advice Panoramic Financial Suggestions is a digital, fee-only economic planning company specializing in more youthful physicians and also physician households.

Owner Andrew Mc Fadden, CFP, MBA, has actually been serving young physician family members for over 8 years, and also is sought by residency programs to speak and enlighten young medical professionals. His well-developed planning approach assists young medical professionals achieve that desirable balance of preparing well for the future, while being able to delight in the here and now.

The Main Principles Of Financial Advice Websites

Most Recent WCI Podcast Look # 6 Integrity Wide Range Solutions Honesty Riches Solutions (IWS) is a tiered flat-fee possession administration as well as financial planning firm concentrated on assisting physicians, dental practitioners, people and also small service owners in a clear and fair fashion. We stick to inexpensive, tax-efficient profiles based on the customer's detailed financial preparation goals.

Our wealth management fees range in between $1,250 to $3,750 a quarter, that includes both financial investment management as well as monetary preparation. We are thrilled to see just how we can help you! Please call Justina Welch or Clint Thomas for a corresponding examination. # 7 Fox & Company Wide Range Monitoring Johanna Fox Turner, Certified Public Accountant, CFP, RLP Johanna is the owner of Fox & Co

https://www.youtube.com/embed/H4oWXBFH8uo

. Wide range Management. Both companies make use of a level cost framework for year-round preparation, investment administration, as well as tax obligation services for medical professionals and dental professionals. 90% of our business is virtual and also you can be 100% certain you're dealing with a fiduciary. Johanna has 36 years of experience recommending company and also HNW customers on riches protection as well as all natural economic preparation, including tax obligation techniques, estate preparation, company operations and sequence planning.

# 8 Medical Professional Riches Services When my partner was in residency, I saw just how susceptible she was to bad monetary recommendations. I was surprised at exactly how several consultants attempted to capitalize on her and her peers. It's the reason I started my fee-only practice, Doctor Wide range Services, to work specifically with doctors that can truly benefit from objective, http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/finance tips top quality monetary suggestions.

All About How To Invest

To help them feel in control of their money, similarly that you make an individual really feel much better regarding their health https://en.wikipedia.org/wiki/?search=finance tips and wellness. Likewise, I organize the Financial Residency podcast, a totally free source to assist raise your monetary proficiency. Come join the area! Below is the podcast meeting I finished with WCI in September 2018.

Getting My How To Invest To Work

9 Simple Techniques For How To Invest

To that end, you must know that several marketers pay us a reference fee if you purchase items after clicking links or calling contact number on our website. The complying with companies are our partners in Personal Finance: The , Morningstar, Personal Capital, therefore Fi. We often use costs or additional positionings on our internet site and also in our advertising and marketing products to our advertising and marketing companions.

As an example, when firm ranking is subjective (meaning 2 firms are extremely close) our advertising and marketing partners may be rated higher. If you have any kind of details concerns while considering which service or product you may buy, do not hesitate to get to out to us anytime. If you pick to click on the links on our site, we may receive payment.

https://www.youtube.com/embed/PAg2UWrMZwk

Ultimately the choice is yours. The evaluations and also viewpoints on our site are our own and also our editors as well as staff writers are instructed to preserve content honesty. Our brand, Customers Advocate.org, represents accuracy and helpful information. We understand we can only achieve success if we take your rely on us seriously!To locate out even more about how we generate income and also our editorial procedure, click on this link.

The Main Principles Of How To Manage Your Finances

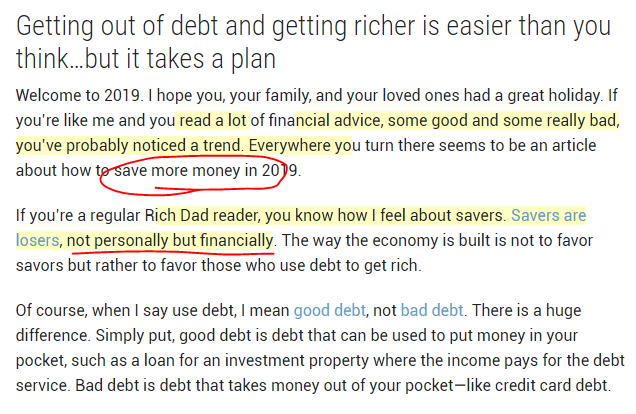

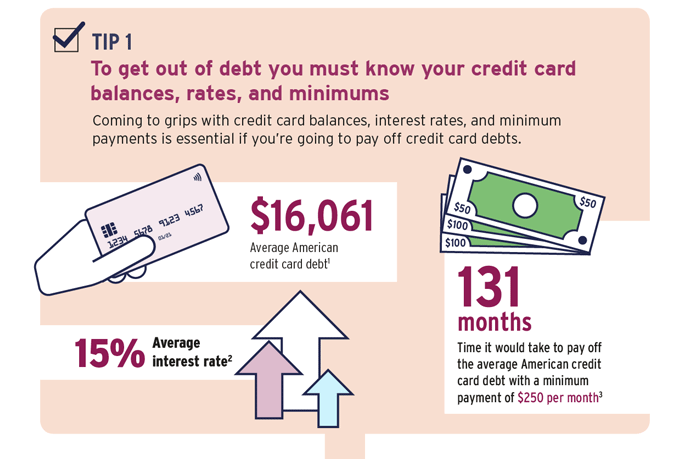

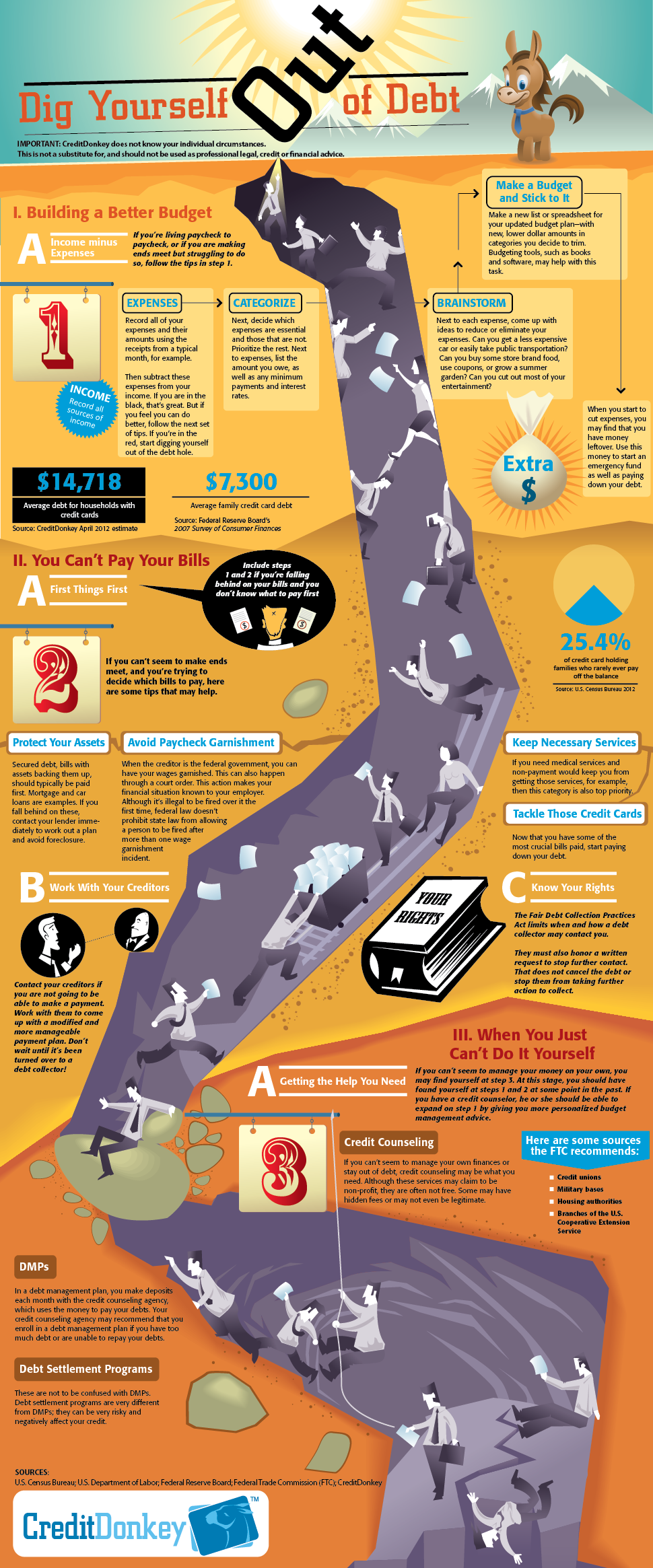

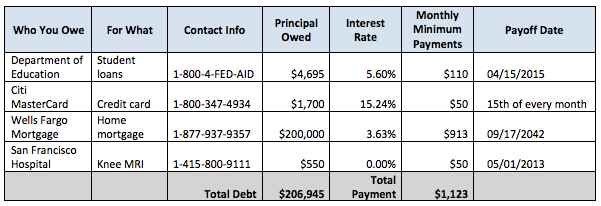

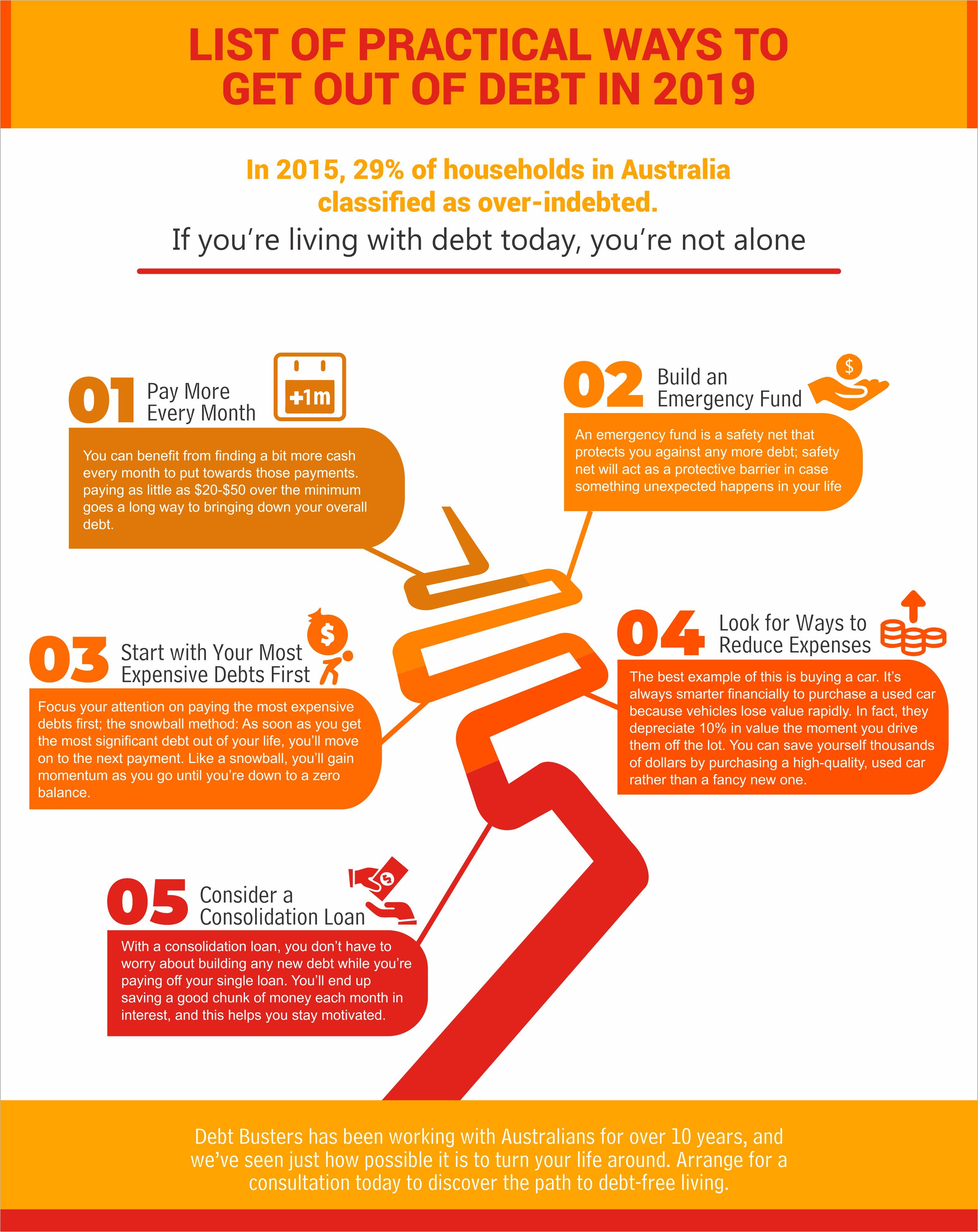

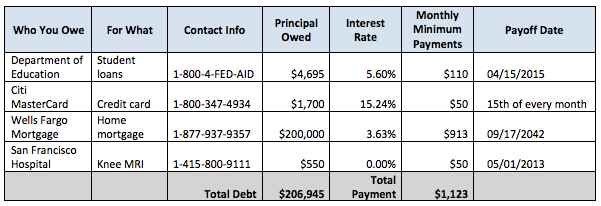

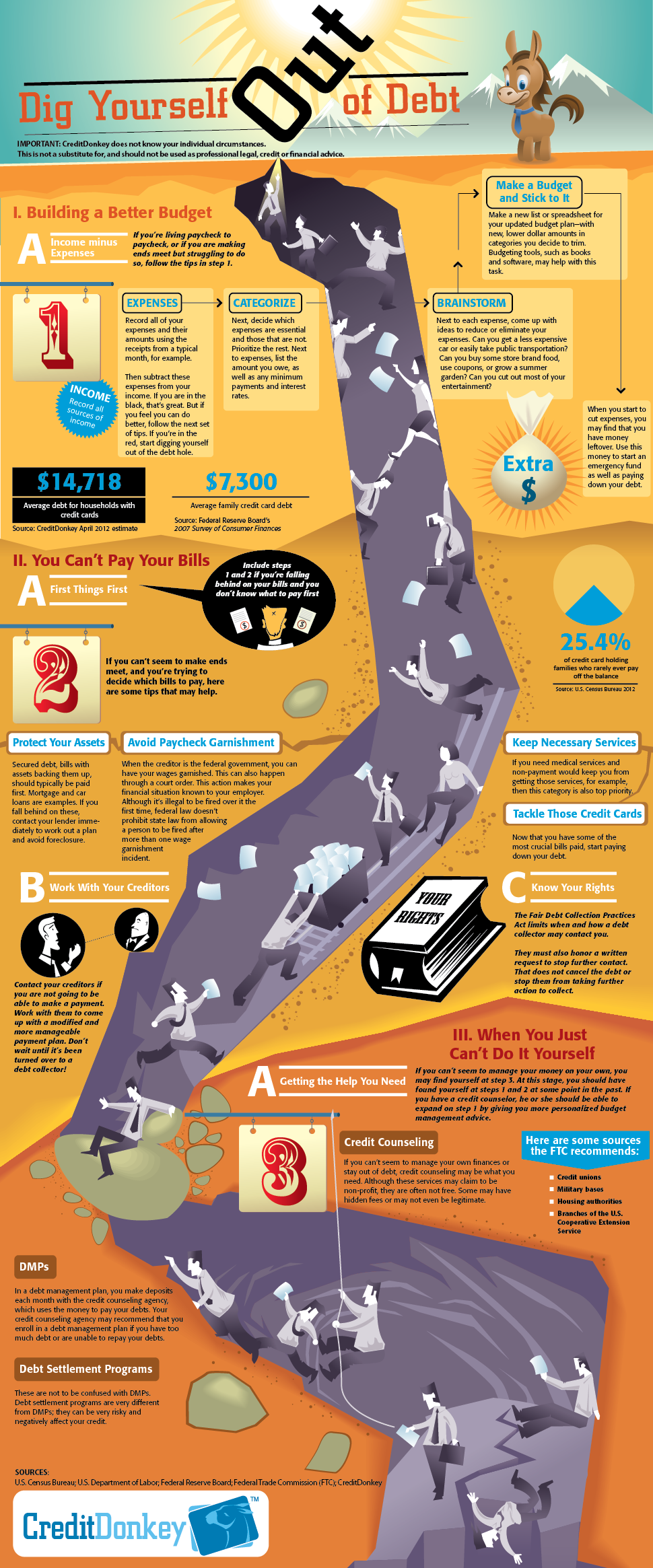

Financial debt is just one component of your total financial allbusiness.com/best-government-websites-for-financial-information-93954-1.html image. It's absolutely an essential item of the puzzle, however you have to comprehend it in connection with other parts of your monetary life if you desire to be absolutely effective. To put it simply, in enhancement to knowing just how to handle debt, you need to comprehend the fundamentals concerning key economic topics like budgeting, saving, keeping good credit history as well as planning for the future in order http://edition.cnn.com/search/?text=finance tips to have a balanced financial life.

Significant life occasions like obtaining wedded as well as having youngsters have a large effect on your ability to preserve economic stability, while unanticipated life occasions like an ailment, discharge or identity burglary can derail also the finest laid monetary strategies if you do not require time to prepare in advance. This section of our web site is developed to assist you achieve a much better understanding of personal finance, as a whole, so you can find out exactly how to construct a steady expectation that supports achieving your economic objectives without tackling financial debt or placing your security at danger.

Below's a simple, 60-second introduction of every little thing you need to learn about managing your money. Great finance is essentially a really skillful balancing act. You need to make certain you're investing, financial obligation, and savings are proportional to your earnings degree. Otherwise, you end up with financial debt troubles as well as can not reach your economic goals, like retiring in a timely manner, getting a home, or sending your kids to university without the concern of high pupil lending financial obligation.

The Only Guide to Financial Advice

As one of the most crucial number in your economic portfolio, an excellent credit report rating suggests less cash invested in rate of interest and the very best terms on lendings, including your home loan. So whether you're simply beginning out or you're currently enjoying your gold years, excellent money is important for a stable as well as effective life.

It's the foundation of a strong financial expectation since it helps regulate spending beyond your means so you can avoid issues with financial debt. You can likewise intend strategically to save money as well as accomplish your financial objectives without depending on credit scores. The following sources can aid you discover exactly how to budget plan: Your credit profile and also credit history are utilized to make essential choices regarding your credit reliability as well as your obligation as a customer.

With that in mind, it's essential to recognize how your credit rating account is built as well as just how information in your credit report establishes your score so you can take activity to keep the very best credit scores possible. These resources can aid you understand credit scores as well as your credit history: Creating effective approaches for saving money and understanding just how to designate that savings properly to aid you accomplish your objectives can aid you avoid troubles with financial debt.

About Financial Advice

These resources can aid increase your cost savings as well as construct reliable saving strategies: As most individuals's key income source, it's vital to obtain the ideal job with the very best salary as well as advantages to support your economic goals. Exactly how you handle work difficulties can make or recover cost the most effective financial plans.

These resources can aid address challenges associated with work: Attaining monetary security now is crucial, but you additionally require to be planning ahead for lasting security, also, especially when it comes to retirement. Guaranteeing you have enough cash and properties to retire promptly can be tough especially if you encounter economic challenges like debt problems in the here and now.

The following resources can help you accomplish a debt-free retirement: Trainee finance financial debt has ended up being a dilemma that is triggering several young Americans to start their economic lives in a significant opening. Moms and dads need to plan ahead to aid their children as long as https://www.pocketrate.com possible, while those pupils act to guarantee they minimize possible issues with financial debt as a lot as feasible.

3 Simple Techniques For Financial Advice

From locating the one as well as ensuring you get on the exact same monetary page to preparing a wedding, there are lots of manner ins which real love can additionally cause serious debt. Also after you celebrate a marriage, it takes job to have an effective financial life with each other, specifically when you begin a family members.

Whether it's a good occasion like taking a trip or commemorating the holidays with your family members, or something possibly destructive, like a fatality of a spouse or a natural disaster, every one of these occasions influence your capacity to manage your money and avoid financial distress. http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/finance tips These resources aid you overcome monetary difficulties brought on by life events: Service participants, veterans as well as their households face some special financial obstacles not seen in the noncombatant sector.

These resources are designed to help military households attain stability: Women likewise deal with some unique difficulties when it pertains to excellent finance. It is essential for females to recognize just how to deal with obstacles so you can be successful whether you're on your very own, in a relationship, or supporting a family. These resources can aid ladies come to be better money supervisors:.

The Greatest Guide To Online Finacial Advice

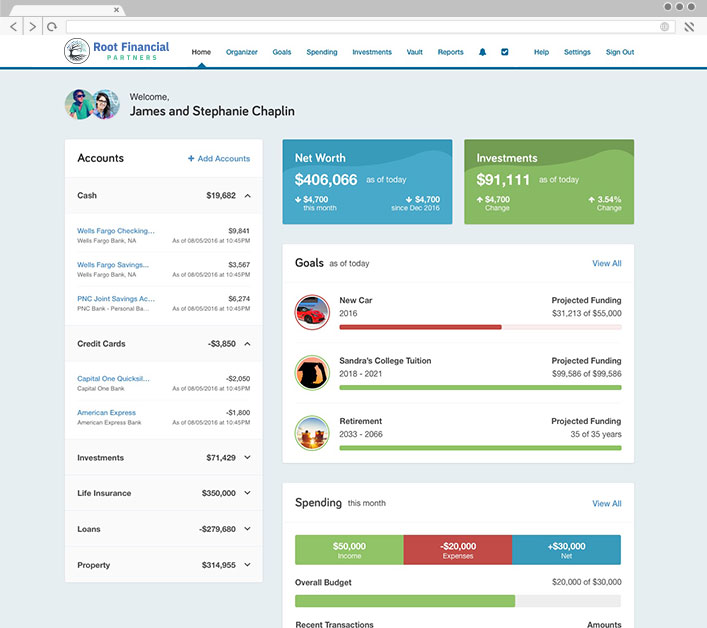

User-Friendly Configuration and also Modifying Our websites are fast to develop and simple to keep thanks to an intuitive, interactive editing device. Choose to build your site yourself or choose web site onboarding for concierge setup. Our ingenious layouts make it very easy for you to build your internet site in plain minutes; simply select your layout, personalize the layout and include content from our ever-expanding FINRA-reviewed material library.

And also, make the most of our: Free helpdesk assistance Integrated compliance evaluation Seo In-depth internet site analytics Modern, Personalized Layouts and also Attributes Different yourself from the competition and advertise your brand when you choose as well as personalize among our many readily available designs. Including flexible designs, customizable shades, callouts and also even more, your website will certainly really feel one-of-a-kind and speak to your one-of-a-kind brand.

Our templates and included site attributes enable you to: Incorporate your very own logo design as well as other brand name elements Add custom-made web content such as account gain access to links and top quality documents Stay existing on web site protection ideal methods Engage prospects and clients with fresh content Client Engagement Devices Engage with your customers as well as prospects and maximize your web site ROI.

What Does Finance Blogs Do?

Our professional, easy-to-digest material is FINRA reviewed and also ready to release. These prompt updates maintain your leads and clients returning to your web site for a lot https://en.search.wordpress.com/?src=organic&q=finance tips more, enhancing your organisation developing capacity. Our interaction sources include: Educational video clips on timely financial subjects Research and also newsletter short articles that offer clients actionable information Interactive monetary calculators customers can use to examine "what-if" situations Magazine-style flipbooks that show key economic principles 24-hour access to stock performance Quote request types Refer a pal forms Event as well as seminar calendars and enrollment Custom Design Providers If you're searching for an absolutely one-of-a-kind site for your advisor method, our Custom Design Providers team is readily available to help.

The Most Effective Ways to Consider Investing Your Money-- Learn Just How

Getting My Invest In Stocks To Work

As well as, as monetary expert Anthony Montenegro of The Blackmont Team explains, the higher the interest saved, the greater the passion made. And also, there are fringe benefits that feature paying for financial debt. Montenegro notes that paying off debt can reduce your use and also boost your credit report as a result.

By paying off financial obligation, you have actually increased your credit reliability as well as helped put even more money in your pocket currently and later on, he says. 2019 can become the greatest year for marijuana supplies yet. Click below to obtain the name of this top quality supply poised to profit from the sector's quick development.

https://www.youtube.com/embed/JShQsAuOpPk

Have a little extra jingle in your pocket Possibly a job bonus offer just came with, you've lastly repaid your auto loan, or your kids graduated college as well as that tuition costs is currently a distant memory. Or, perhaps you're just planning ahead as well as preparing for your long-lasting financial future.

The Buzz on Beginner Investments

That's where we can be found in! Today, we're sharing what to invest in 2019 and beyond. Position your bank on any of these 7 sectors and also possibilities https://en.wikipedia.org/wiki/?search=best financial advice are high that you'll obtain the returns you are worthy of. Prepared to learn extra Allow's go! 1. The Stock Market Specified by its turbulent drops as well as moves, investing in the supply market isn't for the faint of heart or https://www.washingtonpost.com/newssearch/?query=best financial advice the temporary capitalist.

While there are myriad aspects adding to this negative overview, the fact is that we have actually been right here prior to and also we'll be here once more. As the economy is a living and also moving entity, there will certainly always be durations of development and also scarcity. Still, if you want to stick it out, the securities market can aid grow your financial investment in time with a basic higher energy.

A prominent way to buy this market is to exercise buck price averaging. Simply put, this suggests putting a collection quantity monthly right into private stocks so you can make the most of affordable periods. Or, you may pursue low-cost index funds, instead. If you go this path, your consultant can assist you navigate your options.

How Beginner Investments can Save You Time, Stress, and Money.

Peer-to-Peer Financing Though the concept might be new to you, peer-to-peer borrowing has been around for ages. This is an agreement between you and one more celebration, in which you accept give cash for an expense, making a collection amount of interest for doing so. As opposed to functioning this out with a close friend or member of the family, go through a specialist source such as Lending Club rather.

With this kind of platform, you can spread your financial investment out, aiding to cover hundreds of financial investments with a couple of clicks, giving just $25 to each one. Small investment possibilities like these safeguard you from putting all of your monetary "eggs" right into the basket of a total stranger.

They can be an best financial advice for college graduates optimal way to earn a passive revenue if you're up for the procedure. 3. Property Simply like the stock market, realty will not constantly be lightning-hot, all of the time. Still, it's proven to be a solid bet for savvy financiers that know exactly how to handle the documentation, lingo, as well as red tape.

The smart Trick of Best Investments That Nobody is Talking About

If you aren't frightened by a little effort, you can invest in residential properties to renovate and also flip for an earnings. Or, you can buy rental residential properties as well as locate tenants. Not thinking about handling physical residential properties Why not explore Realty Investment Counts On (REITs) With these, you'll ride the wave as well as revenue every time the industry is up, but you'll keep your hands tidy.

The main drawback to this technique is that you can not liquidate those assets as well as stroll away with cash money if rates dive and also you're prepared to leap ship. 4. Your Work Wish to go after a financial investment that you understand will just increase from right here Search in the mirror! Despite what's happening with the economic climate, you can never ever shed when you spend in your expert future.

Even if you're not quite all set to return to college, see if there are any type of means you can make on your own a better worker. Could you go to a training workshop or earn an additional credential or qualification Would you be prepared to cross-train in one more division Even if you're a high-ranking supervisor or a C-suite executive, there is constantly ground to get.

Some Known Questions About Invest In Stocks.

The good information is that in today's digital age, there are lots of methods to hone your craft from the convenience of your house. Pay attention to podcasts regarding your particular niche, stay well-informed on the most recent news updates and also add to the conversation when you can. 5. Your Health Comparable to buying your job, this is one area in which you can take pleasure in individual growth along with financial benefits.

Make your plate a rainbow and also begin taking the stairways to your office. In addition to your physical well-being, don't discount the relevance of mental health. Take time everyday to inspect in with your feelings as well as do not be afraid to go back and require time for on your own when you need it.

If you're really feeling more stressed than usual, ask yourself why and also take the necessary steps toward alleviation. All of us have one life, as well as this is one location where it's hard to overspend. 6. Your Pile of Financial Obligation Searching for a method to see the tangible impacts of your investment in a fast means Beginning by paying off the financial debts you're presently accruing.

Our Invest In Stocks Statements

Keep in mind that your personal wide range thinks about both your properties and also your responsibilities. When you can make those obligations diminish, you're worth much more! Start with your overpriced charge card financial debt. Pay greater than the minimal settlement and get that number down as high as you can to lower the quantity of rate of interest you're required to pay.

In the process, you'll offer your credit report a valuable increase! 7. A Side Task Quick: Believe regarding everyone you know that functions a side hustle. Chances are, you can rattle off a list without hesitation. Thanks to innovation, we're a lot more connected than ever previously and also we have accessibility to opportunities that generations prior to us really did not have.

Then, want to see how you can earn a 2nd earnings from them. As an example, individuals that like to write may consider ending up being freelance bloggers. Knitters, graphic designers, musicians as well as more can discover a financially rewarding outlet on online industries such as Etsy. From driving an Uber to delivering Instacart grocery stores, the net has made it possible for us to find well-paying jobs that don't reduce too much into your personal life.

The Ultimate Guide To Invest Money

It indicates you're eager to look in advance down the road rather than pursuing instant enjoyments that might cost you. Yet, with many alternatives within your reaches, it's natural that you intend to see to it you're choosing the ideal route. Currently that you know what to purchase 2019, you prepare to make this year your most gratifying one yet! Start tiny, do your homework, and ask a lot of questions.

Desire more real-world pointers you can utilize We have actually got them on our blog, so comply with along! Fascinated in discovering what modern-day millennials are buying The answer might amaze you as well as you may intend to follow match, so look into our overview!.

Senior Investments: What Are Have a peek at this website the Best Investments for Retired Life Updated on Apr 08 2019 Discover some of the most effective financial investments for retired life to develop a savings that will certainly enable you a https://en.search.wordpress.com/?src=organic&q=best financial advice retirement way of life you deserve. While timing is necessary to investing, smart investments at any type of age can be reliable.

Examine This Report about Online Finacial Advice

Excitement About Finance Blogs

Guide ought to be watched as a necessary survival package for all instantly singles. The Budget Plan Set By Judy Lawrence This publication has a simple, practical approach to understanding and taking care of one's economic life. The referrals and examples are fantastic, and the "broad view" is interacted effectively. Guide is a complete package on its own, and the associated Website uses a lot more exceptional recommendations as well as helpful tools.

Solin, Esq. This publication discusses how investors can stay clear of being victimized by brokers and also just how to obtain their cash back if they incurred losses therefore broker misconduct. An outstanding primer for those wishing to obtain "the within skinny" of the broker agent business. Reveals capitalists the different forms of broker scams, and helps them establish if they have a case.

You Do not Need To Be Rich: Comfort, Joy and also Financial Safety And Security by yourself Terms By Jean Chatzky Chatzky, that is with NBC's Today https://www.washingtonpost.com/newssearch/?query=best financial advice Show and Money Publication, creates an informative book that shows can show you how to make monetary decisions to make you truly delighted regardless of your monetary means.

Extremely motivating. The Richest Male in Babylon By George Clason A collection of parables composed in the http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/best financial advice 1920s, this publication is a timeless, motivational job. Terrific guidance when it come to thrift, economic preparation as well as personal riches, that is simply as sound today, as it was 80 years ago. Your Money or Your Life: Changing Your Partnership With Cash and also Getting Financial Freedom: Totally Revised as well https://en.search.wordpress.com/?src=organic&q=best financial advice as Updated for 2018 By https://www.goodreads.com/topic/show/20781628-the-best-guide-to-financial-advice-websites Vicki Robin and also Joe Dominguez This is a very successful book on how to obtain control of your money and your life.

8 Easy Facts About Online Finacial Advice Described

The Millionaire Next Door By Thomas Stanley as well as William Danko As opposed to what several may think, the majority of millionaires are not fancy. This publication provides you a good consider the account of a common millionaire, just how they arrived, and also exactly how you can pick up from their behaviors. Who recognizes, you could even end up being the following Millionaire Next Door.

It is designed to walk you via the often perplexing and worry-producing globe of cash. 7 Phases of Cash Maturation: Understanding the Spirit as well as Value of Money in Your Life By George Kinder, CFPThis financial advice quotes is a publication that looks for the spiritual meaning in wide range, as well as tells the stories of three composite personalities throughout the book.

Named as "one of the most prominent people in the monetary planning market" (Investment Expert magazine, June 2003), George is the creator of The Kinder Institute of Life Preparation, an individual empowerment as well as training company that supplies the highly-acclaimed 7 Phases of Money Monitoring Workshop. Lots Of Money, Straight Talk about Investing for Retired Life By Rick Ferri, CFASerious Cash discusses why financiers, financial investment companies, monetary specialists as well as the information media do not constantly have your benefits in mind.

That Gets Grandma's Yellow Pie Plate By Marlene Stum This is a sensible, down to planet guide on exactly how to manage the circulation of family products from one generation to the next. The goal is to have the procedure be a party of the deceased person's life, instead of allowing emotions to damage or damage family members relationships.

The Of How To Manage Your Finances

It has actually simply been upgraded, as well as currently considers the dot-com disaster. Among various other subjects, Malkiel offers an amusing history of previous market bubbles, and also discusses why it's not worth trying to defeat the marketplace. There is likewise a life-cycle overview to purchasing the market.

https://www.youtube.com/embed/urhYH6yIgNw

We believe that financial preparation ought to be individual, thoughtful, as well as practical. As fee-only monetary coordinators in Columbus, Ohio, we are paid only by you for the work we execute in your place. This enables us to act as true fiduciaries to do what is right for you. While many companies only give due diligence or push you into products that pay them a compensation, we learn more about you.

We look into readily available alternatives as well as consider the aspects that impact you. We provide audio advice, without jargon, to assist you attain your goals. And also we remain in touch, due to the fact that life inevitably influences even the ideal laid plans. At PDS, we understand that a financial plan progresses with you. Our team is dedicated to collaborating with you each action of the method.

We are an independent Registered Investment Advisory firm offering high-net-worth families and also individuals nationwide from our location in Wayne, NJ. We differ from various other companies since we emphasize a team approach to handling your financial resources and also financial investments. Though you work with a key riches consultant, you constantly get the assistance of our entire team.

The smart Trick of Finance Blogs That Nobody is Talking About

Content Note: Credit rating Karma gets compensation from third-party advertisers, but that doesn't affect our editors' opinions. Our advertising and marketing companions do not evaluate, accept or recommend our editorial material. It's precise to the most effective of our understanding when it's published. Marketer Disclosure We think it is necessary for you to comprehend how we earn money.

The offers for financial products you see on our platform come from business that pay us. The cash we make helps us offer you access to cost-free credit scores and records as well as aids us produce our other fantastic devices as well as academic products. Compensation might factor into just how and where products show up on our system (as well as in what order).

That's why we give functions like your Authorization Odds and cost savings estimates. Certainly, the offers on our system do not stand for all economic items available, however our objective is to show you as many wonderful choices as we can. A monetary adviser can aid you navigate the sometimes-treacherous waters of finance and also provide support on the journey towards your monetary objectives.

Financial consultant is actually a basic term that is commonly made use of to explain any individual in business of helping others with their financial resources. A monetary adviser may assist with anything from basic monetary planning to investment monitoring to tax and also retirement approach, as well as it can depend on their specialty. Financial advisors may or may not have a range of credentials, education and learning backgrounds, professional experience and costs connected with their services.

Examine This Report on Finance Advice Online

Working on your credit report Examine My Equifax as well as Trans Union Ratings Now What is a monetary advisor An economic advisor can function as an economic coach, assisting you recognize when to make sure financial decisions. Sometimes, economic consultants can handle the logistics of lugging out those choices as well.

As well as specific financial advisors might have a lot more competence in one area than an additional. Anne Mank, CFP, CPA, wealth consultant at Ellenbecker Financial investment Team, places it by doing this: "Some advisers will simply provide a particular investment suggestion like 'You need to buy supply 123,' as well as some will definition of financial advice australia certainly finish an entire monetary strategy, including estate recommendations, insurance planning and tax methods, along with investment portfolio recommendations." Two certain sorts of economic consultants that you might stumble upon are financial organizers as well as investment advisers.

Some often tend to concentrate on offering their clients a more-comprehensive point of view as well as assist with their finances. Some financial coordinators will certainly develop a customized financial strategy to aid a client with everything from budgeting to estate preparation to determining what to buy. But solutions may differ extensively from one monetary planner to an additional; some might only be able to provide a restricted variety of services and products.

If you're taking into consideration employing a CFP, you can check the Licensed Financial Planner Board Requirements to confirm their accreditation condition. QUICKLY FACTS The ABCs of economic adviser credentials There are lots as well as lots of various designations or accreditations that economic consultants have but not all are created equivalent. For example, while the education and learning demands for a CFP consist of a bachelor's degree, a recognized financial counselor (or AFC) accreditation calls for 2 self-study programs no college education required.

A Biased View of Online Finacial Advice

Facts About Financial Advice Websites Uncovered

The book must be watched as a necessary survival package for all unexpectedly songs. The Budget Plan Set By Judy Lawrence This publication has a straightforward, no-nonsense approach to understanding and managing one's economic life. The referrals and also examples are superb, and the "large picture" is interacted efficiently. The book is a complete set by itself, as well as the associated Internet site uses much more outstanding recommendations and also helpful tools.

Solin, Esq. This book talks about exactly how capitalists can avoid being preyed on by brokers as well as just how to obtain their cash back if they incurred losses therefore broker transgression. An exceptional primer for those wanting to obtain "the inside skinny" of the brokerage company. Shows investors the various forms of broker scams, and assists them figure out if they have a case.

You Don't Need To Be Rich: Convenience, Joy and Financial Security by yourself Terms By Jean Chatzky Chatzky, who is with NBC's Today Program as well as Cash Publication, produces an insightful publication that shows can show you just how to make monetary choices to make you really happy no issue your economic methods.

Very inspiring. The Richest Guy in Babylon By George Clason A collection of parables written in the 1920s, this book is a timeless, inspirational work. Wonderful suggestions when it come to second hand, financial planning and personal wide range, that is simply as audio today, as it was 80 years earlier. Your Money or Your Life: Transforming Your Relationship With Cash and Getting Financial Independence: Totally Changed as well as Upgraded for 2018 By Vicki Robin and also Joe Dominguez This is Click here for more a very popular book on how to obtain control of your cash and your life.

What Does Financial Advice Websites Do?

The Millionaire Next Door By Thomas Stanley and also William Danko As opposed to what lots of might believe, a lot of millionaires are not showy. This book gives you a great look at the profile of a typical millionaire, how they arrived, as well as exactly how you can gain from their behaviors. Who understands, you may even become the following Millionaire Next Door.

It is developed to stroll you with the often confusing and also worry-producing globe of cash. 7 Phases of Money Maturity: Recognizing the Spirit as well as Value of Cash in Your Life By George Kinder, CFPThis is a book that looks for the spiritual significance in wide range, and tells the tales of 3 composite characters throughout guide.

Called as "one of the most significant people in the monetary preparation industry" (Investment Expert magazine, June 2003), George is the creator of The Kinder Institute of Life Planning, a personal empowerment and also training organization that provides the highly-acclaimed Seven Phases of Finance Workshop. Lots Of Money, Straight Talk regarding Spending for Retirement By Rick Ferri, CFASerious Cash clarifies why stockbrokers, financial investment companies, economic experts as well as the mass media do not constantly have your benefits at heart.

Who Obtains Grandmother's Yellow Pie Plate By Marlene Stum This is a practical, down to earth overview on how to manage the circulation of family things from one generation to the next. The objective is to have the procedure be a party of the dead individual's life, instead of enabling feelings to hurt or destroy family members connections.

Little Known Questions About Financial Advice Websites.

It has actually simply been upgraded, as well as now thinks about the dot-com meltdown. To name a few topics, Malkiel provides an amusing history of past market bubbles, and describes why it's not worth attempting to beat the market. There is likewise a life-cycle overview to buying the marketplace.

https://www.youtube.com/embed/v9x6oQ2wS08

We believe that economic preparation needs to be personal, thoughtful, and practical. As fee-only financial organizers in Columbus, Ohio, we are paid only by you for the job we perform on your part. This permits us to function as true fiduciaries to do what is right for you. While several companies just provide due diligence or press you into products that pay them a compensation, we are familiar with you.

We look into offered alternatives as well as consider the aspects that impact you. We give sound advice, without lingo, to help you accomplish your objectives. And also we remain in touch, because life unavoidably influences even the best laid strategies. At PDS, we recognize that an economic plan develops with you. Our group is devoted to functioning with you each step of the means.

We are an independent Registered Financial investment Advisory company offering high-net-worth households as well as individuals nationwide from our area in Wayne, NJ. We vary from various other firms since we highlight a team technique to managing your financial resources as well as financial investments. Though you deal with a key riches expert, you constantly receive the assistance of our entire team.

The Basic Principles Of Finance Blogs

Editorial Note: Debt Karma receives payment from third-party marketers, but that doesn't affect our editors' opinions. Our marketing companions don't examine, approve or support our editorial content. It's accurate to the ideal of our understanding when it's published. Advertiser Disclosure We think it is essential for you to comprehend just how we make cash.

The deals for monetary products you see on our system come from business that pay us. The cash we make aids us offer you access to complimentary credit report and also reports and assists us develop our other terrific devices as well as instructional products. Settlement might factor right into just how and where items show up on our platform (as well as in what order).

That's why we offer features like your Authorization Chances and also cost savings price quotes. Of course, the offers on our system do not represent all economic items available, however our goal is to show you as lots of great choices as we can. A financial adviser can aid you browse the sometimes-treacherous waters of finance as well as supply assistance on the trip towards your economic goals.

Financial consultant is in fact a basic term that is frequently used to describe any person in business helpful others with their funds. A financial advisor could assist with anything from basic monetary preparation to investment administration to tax obligation and retirement method, as well as it can depend upon their specialized. Financial advisers may or may not have a selection of credentials, education and learning histories, expert experience and expenses related to their services.

Unknown Facts About Finance Advice Online

Working with your credit score Inspect My Equifax and also Trans Union Ratings Now What is a financial consultant An economic adviser can function as a financial train, aiding you comprehend when to make sure financial decisions. In some situations, monetary consultants can take care of the logistics of accomplishing those decisions as well.

As well as particular financial advisers may have a lot more knowledge in one area than one more. Anne Mank, CFP, Certified Public Accountant, wealth adviser at Ellenbecker Investment Group, places it in this manner: "Some consultants will simply offer a particular financial investment suggestion like 'You need to buy stock 123,' and some will finish an entire financial plan, including estate recommendations, insurance policy planning as well as tax techniques, in addition to investment portfolio tips." Two specific sorts of economic advisers that you may discover are financial coordinators and investment advisers.

Some often tend to focus on giving their clients a more-comprehensive perspective and aid with their finances. Some economic organizers will certainly produce a customized economic strategy to help a customer with everything from budgeting to estate preparation to determining what to purchase. However services might vary extensively from one economic coordinator to another; some may just be able to provide a minimal number of products and services.

If you're considering working with a CFP, you can inspect the Qualified Financial Planner Board Specifications to validate their accreditation condition. FAST TRUTHS The ABCs of economic advisor credentials There are dozens as well as lots of various designations or qualifications that monetary advisers have however not all are developed equivalent. For instance, while the education and learning requirements for a CFP consist of a bachelor's degree, a certified financial therapist (or AFC) certification calls for two self-study training courses no college education needed.

Little Known Facts About Finance Blogs.

Facts About Finance Blogs Uncovered

of your life such as the rates of interest you pay on car loans and home loans, and also the cost you pay for insurance policy. Plus, the website has a regular lineup of articles checking out the details of credit, in addition to diving right into subjects such as identity theft and also homeownership.

5. Learn Vest Why we like it: Working with a Learn Vest financial coordinator prices money, however the posts on its web site are free. Discover Vest offers individual tales concerning cash as well as advice from financial coordinators, yet it also has a vast variety of tools: calculators, videos, lists for major life milestones, as well as a budgeting device that likewise can be found in the form of an application.

6. Nerd Pocketbook Geek Pocketbook. Geek Pocketbook Why we like it: Geek Wallet is everything about contrast. You can contrast debt and debit cards, mortgages, investment accounts, and banks, to name a few. Yearly they choose the ideal for each and every category as well as function that on their site also.

7. Quora Why we like it: Quora requires you to create a cost-free account, and you can subscribe with Google, Facebook, or Twitter. The website defines itself as "the most effective solution to any concern," so following time you're having problem with a particular money problem, search Quora to see if anybody else has experienced the exact same battle as well as supplied a remedy.

Some Known Factual Statements About Finance Advice Online

Best for: marilynstarkweatherjunevnrj.tearosediner.net/what-does-online-finacial-advice-mean Visitors who currently have a standard understanding of monetary principles. 8. CNN Money Why we like it: If you're much more thinking about breaking information that relates to money, you'll such as CNN Cash. The website is wonderful at responding to the concern of how current occasions put on and affect your financial resources.

Best for: Discovering just how the news influences your money. 9. I Will Educate You To Be Rich I Will Certainly Educate You To Be Rich. I Will Instruct You To Be Rich Why we like it: The author of the bestselling "I Will certainly Instruct You To be Abundant," Ramit Sethi, created his internet site of the very same name for people who are seeking the "good fortunes." Sethi gives guidance on topics like discovering your desire work, making more cash, as well as beginning your own company.

10. New York City Times: Your Cash Section Why we like it: If you prefer checking out longer items with even more of a narrative, the New york city Times Your Money area is the area to go. While the bigger paper supplies news and insight concerning modifications in the economic sector as well as the international economic climate, Your Money distills this information and deals with cash monitoring for the person.

11. Superstar Money Why we like it: The creator of Superstar Money, "J. Cash," also has his very own personal financing blog, Budgets Are Sexy. He curates the most effective money short articles from a wide web of personal money bloggers and writers "rockstars" and afterwards shares them on Superstar Money. You can join by email to keep up to day and also get the brand-new rockstar short articles daily.

The Single Strategy To Use For How To Manage Your Finances

Just Offer Me the Solution$: Specialist Advisers Address Your A Lot Of Pressing Financial Questions By Sheryl Garrett, CFP, with Marie Swift and also The Garrett Preparation Network, Inc Hiring a financial planner is usually something individuals relate to the affluent. Yet according to monetary master Sheryl Garrett, everyone ought to be able to deal with an economic expert as well as take control of his/her economic fitness.

Sprinkled with real-life stories as well as particular instances, Simply Give Me the Response$ is best financial advice for college students a one-stop source for any person wanting to obtain as well as keep their economic house in order. Cash Without Marriage By Sheryl Garrett, CFP, and Debra A. Neiman, CFP, MBAThis publication supplies financial preparation tools and also methods that allow unmarried couples to resolve the financial, lawful, and also prejudiced issues integral in their living circumstance.

It is an indispensable guide for anyone, of any type of age, that is single and also copes with or is thinking about dealing with a partner. Aware Financing By Rick Kahler, CFP, as https://en.wikipedia.org/wiki/?search=best financial advice well as Kathleen Fox This publication will certainly help you find your unconscious money beliefs and also break their power, changing the duty of money in your life.

The Number: An Entirely Various Way to Consider the Rest of Your Life By Lee Eisenberg" The Number" is the amount of cash you need to have socked away in order to be positive that your blog post retirement life will meet your expectations. Everyone's Number is various as well as while it is essential to conserve sufficient to last Eisenberg claims Americans require to additionally determine just how they want the rest of their life to look.

https://www.youtube.com/embed/ScwCOiLhRp8

Our Online Finacial Advice Ideas

He gives a charmingly created consideration of an aging generation's retirement fears and also of the financial investment business created to benefit from them. Genuine discussions of objectives, health and wellness as well as healthcare, "downshifting" to appreciate life while spending less money and the significance of post retirement life pepper its web pages. His observant evaluation of genuine and fictional people's financial hopes as well as techniques will inspire visitors to reevaluate their Numbers and also their methods for investing.

Eisenberg supplies additional ideas on his web-log (www.thenumberbook.com). No Debt By Lynette Khalfani http://www.thefreedictionary.com/best financial advice If you intend to be debt-free and also attain financial liberty, you require an activity plan to lead you. This publication is your detailed plan and it's basic and understandable. Ten Weeks to Financial Awakening: A Guidebook to the Creation of Your Own Financial Plan Utilizing Quicken Software Application By Paul Lemon This isn't actually a publication, it's a full economic preparation program that will aid you arrange as well as regulate https://en.search.wordpress.com/?src=organic&q=best financial advice your financial resources and also take control of your monetary life.

The Ultimate Credit Rating Handbook: Exactly How to Cut Your Financial debt and also Have a Lifetime of Great Credit Rating By Gerri Detweiler A previous director of Bankcard Owners of America, Gerri Detweiler attracts on her years of proficiency in counseling customers with credit rating troubles to write the clear-cut handbook on how to have more credit score, leave financial debt and also live a life time of financial security as well as prosperity.

Little Known Facts About Finance Blogs.

All About Financial Advice Websites

Although the person that made the insurance coverage pitch advertised himself as a professional in comprehensive economic planning, consisting of estate preparation, retirement income methods, and tax obligation planning, he had no accreditations or licenses in these areas. His Linked In resume said he was a Licensed Economic Planner specialist with Qualified Life Underwriter as well as Chartered Financial get more info Consultant classifications https://www.washingtonpost.com/newssearch/?query=best financial advice via The American University.

Basically, he or she had actually produced a shingle claiming "Obtain your economic suggestions right here" without any qualifications, or any formal defenses for his clients. https://en.search.wordpress.com/?src=organic&q=best financial advice Financial Advisor Warning # 2: Commission-based. The commission-based, product-centric company model is receding, as capitalists realize the unfavorable impact that high sales charges and also purchase expenses can have.

A fee-only model is far more in accordance with clients' interests because the consultant has no incentive to push one brand of products over anotherthe just motivation is to do what is finest for the customer. Learn more A euphemism for a commission-based http://edition.cnn.com/search/?text=best financial advice structure is "We only earn money when you do organisation with us." Do not be misleaded by this as well as ask for an in-depth description of settlement framework.

The terms used to differentiate numerous advisor organisation designs are puzzling. Fee-only implies that the customer is ONLY billed a cost for advice. Fee-based implies the client is billed a charge for best financial advice guidance plus commissions for financial advice definition dealing safety and securities or various other products. Advisors who are "dual-registered" to offer safety and securities as well as insurance policy are fee-based.

Indicators on How To Invest You Should Know

The entire emphasis financial advice website of economic and also investment preparation ought to be the client's individual goals. If the discussion focuses mainly on worry, you must ask why. Are you being offered a product intended to protect versus loss (ie. an insurance policy existing as a financial investment) This was specifically the approach absorbed the discussion our operative went to.

https://www.youtube.com/embed/y6T3ctwQ6vM

As you can see, it looks like it goes right up, with ordinary annual returns of 14.02%. After that he revealed a chart of market returns from 2000-2016it looks a lot scarier and also much more volatile. Typical annual returns were much below the long-lasting average. But remember: equities exchange temporary volatility for long-term development, so we must anticipate a much more volatile chart for shorter amount of time! It makes no feeling to contrast a 30-year timeframe to a 16-year timeframe for equities.

Complete annual return, including dividends, for this duration is 13,025%, which damages down to typical annual returns of 10.87%. While naturally returns suffered because of the outliers of the dotcom bust in the very early 2000s and monetary situation in 2008, in just a couple of brief years markets have gone back to typical double-digit averages.

Financial Consultant Warning # 5: Promotes insurance policy as a financial investment. Do you consider your automobile insurance coverage a financial investment It's something you pay every year and wish you never ever utilize. Life insurance should coincide. It's intended for defense, not growth. It is a.

How To Invest Things To Know Before You Buy

The 4-Minute Rule for Online Finacial Advice

This will certainly aid you in examining just how much you have come as well as which goals you have fulfilled. Use this journal to write down all crucial points such as your short term, mid term and also long-term goals, your present incomes, your routine costs which you https://www.washingtonpost.com/newssearch/?query=best financial advice understand as well as any committed costs which are of repeating nature.

Additionally, it is mosting likely to be a lot extra easier for you to follow you and also track your progress. Now, you ought to be prepared with your economic objectives as well as Check out this site would be doing remarkably with cost savings; now it's time to talk concerning the huge daddy Investments. Making Smart Investments Financial Savings by themselves do not take any individual as well far.

8. Seek Advice From a Financial Advisor Investments does not come normally to a lot of us therefore instead of dabbling with it ourselves, it is important to seek advice from a financial consultant. Speak with him/her concerning your monetary goals and savings as well as after that look for guidance for the very best investment instruments to accomplish your objectives.

Select Your Financial Investment Instrument Sensibly Though your monetary advisor will certainly recommend the very best financial investment tools, it doesn't harmed to understand a bit about them. Just like "no one is born a criminal", no investment tool is bad or great. It is the application of that instrument that makes all the distinction.

The Greatest Guide To Finance Blogs

So as a general policy, for all your short term economic objectives, pick an investment instrument that has debt nature for instance dealt with down payments, debt mutual funds etc. The factor for going with financial debt instruments is that possibilities of resources loss is less as contrasted to equity tools. 10. Worsening Is the Eighth Marvel Einstein when said about compounding, Compound Passion is the 8th wonder of the world.

So make buddies with this wonder youngster. And also sooner you become close friends with it, quicker you will get to closer to your economic goals. Beginning spending early to ensure that time is on your side to aid you bear the fruits of intensifying. 11. Procedure, Action, Action Everyone do good when it involves earning more per month yet stop working badly when it involves measuring the investments; taking stock of how our financial investments are doing.

If we don't measure the progression prompt, then we would certainly be firing at night. We wouldn't understand if our saving rate is ideal or not; whether economic advisor is doing a good work; whether we are moving closer to our target or otherwise. Do procedure every little thing. If you can not gauge all of it on your own, ask your economic advisor to do it for you.

As you can see, all it calls for is technique. But hunch that's the most challenging part! Even https://en.wikipedia.org/wiki/?search=best financial advice More About Personal Finance Management Featured image credit scores: rawpixel by means of unsplash.com.

The Of How To Manage Your Finances